When you create a new account in the chart of accounts, select the account type first from the list that QuickBooks populates for you. Remember, this is the part that affects your accounting so you want to make sure you get this right. Categories play a crucial role in QuickBooks Online as they enable businesses to track and manage their business expenses, providing essential insights for effective financial management. Lastly, editing or deleting categories gives you the flexibility to adapt to changes in your business. By regularly reviewing and maintaining your categories, you can keep your Chart of Accounts up to date and reflective of your evolving needs.

Understand the importance and purpose of account types

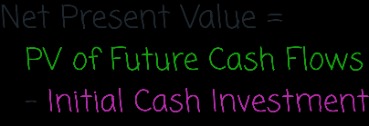

By correctly step by step guide on discounted cash flow valuation model assigning categories to your transactions, you can streamline your bookkeeping process, improve financial reporting accuracy, and gain valuable insights into your business’s finances. The chart of accounts is the backbone of QuickBooks and the foundation of your company’s accounting processes. Neglecting the regular review and adjustment of categories in QuickBooks Online can result in outdated classification, inaccurate reporting, and suboptimal alignment with the business’s financial management needs. Neglecting to use categories in QuickBooks Online can lead to disorganized financial records, making it difficult to track expenses and revenue accurately.

By following a few simple steps, you can create new categories that align with your specific business needs and provide a clear view of your financial activities. Remember to give each category a meaningful name, assign the appropriate account detail type, and consider nesting categories within parent categories to create a hierarchical structure. Once you have defined the details of the category, you can continue adding and customizing additional categories to accurately track and report on your business transactions. QuickBooks Online allows you to have a comprehensive system in place, providing you with valuable insights into your financial health and performance. Effective category management involves maintaining consistency, establishing standards, providing training to your team, utilizing reports for validation, and performing regular account reconciliation.

This approach plays a pivotal role in ensuring that financial records are properly organized, making it easier to identify trends and generate reliable reports. Consistent categorization also enhances the ability to track expenses, manage cash flow, and make informed business decisions. By standardizing categories, users can optimize the software’s capabilities, resulting in improved efficiency and accuracy in financial record-keeping. In summary, tags in QuickBooks offer a flexible and customizable way to further classify and organize your transactions. In summary, utilizing subcategories in QuickBooks allows for better organization and improved tracking of your financial data. By creating hierarchical structures within your existing categories, you can gain a more detailed breakdown of your transactions and streamline your financial reporting process.

This process allows businesses to adapt to changes in their financial structure, identify potential cost savings, and allocate resources effectively. By aligning categories with specific business activities, it becomes easier for companies to track income and expenses, analyze financial trends, and make informed decisions. Regular updates also aid in meeting compliance requirements and provide valuable insights into the overall financial health of the business.

Step 2: Creating a New Category

They play a crucial role in helping businesses 33 proven ways to monetize a website track expenses, identify tax-deductible items, and analyze spending patterns. By categorizing income, businesses can gain insights into their revenue sources and make informed decisions. By adding descriptions, assigning default tax codes, and setting categories as active or inactive, you can enhance the accuracy and relevance of your financial reporting.

Use Subcategories for More Detailed Tracking

This article will guide you through the process of adding categories in QuickBooks Online, step by step. By following these instructions, you can customize your Chart of Accounts and have a clearer view of your business finances. You may need to modify or adjust categories to better align with changes in your income and expense patterns. Regularly evaluating and updating pre-set categories helps maintain the relevance and accuracy of your financial record-keeping. Every account listed in your chart of accounts has both an account type and a detail type.

- This categorization process allows companies to effectively track and analyze their income and expenses for each product or service.

- Consistent categorization also enhances the ability to track expenses, manage cash flow, and make informed business decisions.

- By utilizing tags effectively, you can track and analyze your transactions in a way that aligns with your unique business needs.

- These categories aid in resource management by identifying areas of overspending or potential savings, ultimately contributing to improved efficiency and profitability.

- As your business evolves and financial patterns change, it is essential to adapt your categories accordingly.

Regular review of categories allows for adjustments to align with changing business needs and financial goals, ultimately contributing to better decision-making and financial management in QuickBooks Online. Categorizing transactions in QuickBooks Online is essential for accurate financial tracking and reporting, allowing businesses to gain insights into their income and expenditure. By specifying the account detail type, QuickBooks Online ensures that the category is correctly categorized and included in the appropriate financial reports. This will enable you to analyze your business’s finances more effectively and obtain a clearer view of your operations. Remember that while importing categories can be efficient, it is essential to review and verify the imported data. Mismatches or errors in the import process can impact your financial reporting if left unchecked.

By setting the category as active or inactive, you have cost benefits analysis for projects control over whether it is available for use in transactions. This can be helpful when you want to temporarily disable a category or prevent accidental selection. Inactive categories will not appear in dropdown menus when recording transactions, reducing clutter and streamlining the selection process.